Medicare is a complicated health insurance program for seniors in America. This nearly 55-year-old program includes several parts and plans that provide both older adults and adults with particular disabilities comprehensive coverage.

The trick to learning the details of each part Medicare is breaking them up into bite-size pieces. Once you have a solid understanding of each part of Medicare, you can start piecing them together with supplemental options to build the most suitable coverage for yourself.

There are two main parts of Medicare called Original Medicare

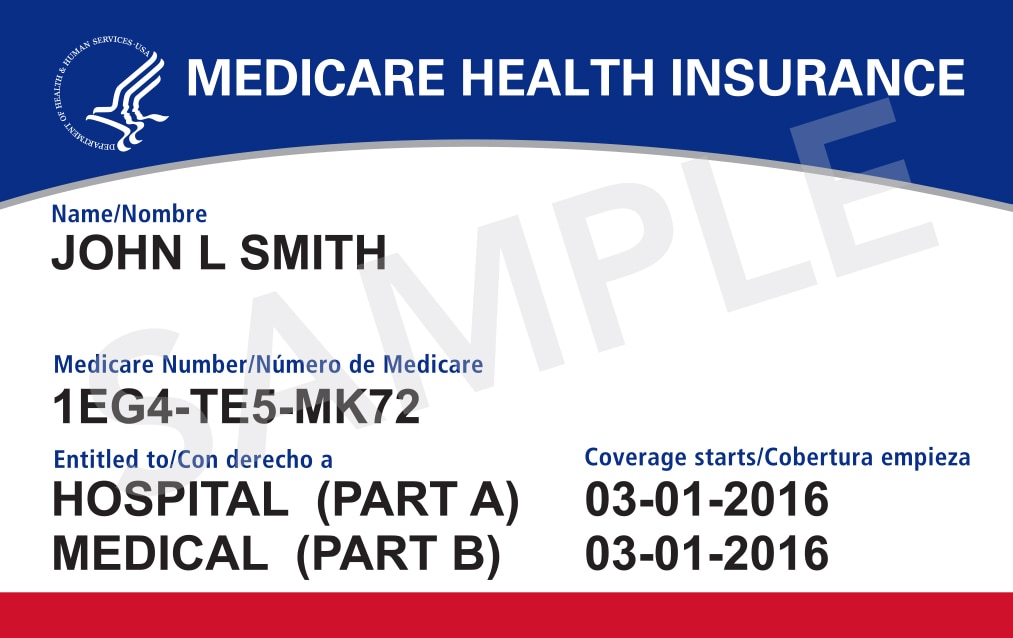

Medicare was first made up of two parts, Part A and Part B. These two parts are known as Original Medicare.

Medicare Part A

Medicare Part A provides beneficiaries with inpatient stay coverage. Coverage includes, but is not limited to, hospital stays, skilled nursing facility stays, and short-term home health care.

Part A is paid for by Medicare taxes. Once you have paid Medicare taxes for at least ten years, you will have earned premium-free Part A. However, if you don’t have that work history through yourself or a spouse, you may owe a Part A premium at 65.

The deductible for Part A in 2019 is $1,364 and can be owed more than once a year if you have multiple inpatient stays. The deductible covers your first sixty days in the hospital as well as your first twenty days in a skilled nursing facility. Stays that continue past the covered days will have a daily copay.

Medicare Part B

Medicare Part B provides Medicare beneficiaries with outpatient and inpatient medical services. Coverage includes, but is not limited to, doctor exams, lab work, x-rays, durable medical equipment, and preventive care. Most people pay $135.50 per month for Part B in 2019. Depending on your income, you may pay a higher or lower premium than the base premium.

Medicare Part B also has a once-annual deductible as well as coinsurance and copays when you receive care. The deductible for Part B is currently $185 per year. Once you pay $185 for Part B services, Part B will cover 80% of covered services, and you will pay 20%. This is your Part B coinsurance.

Other parts of Medicare are sold by private insurance carriers

The other parts of Medicare that you can enroll in through private insurance carriers are Part C and Part D. Part C, also known as Medicare Advantage, is completely optional. Part D, the prescription drug coverage program under Medicare, is also optional, but you can be penalized for enrolling in it after a certain time frame.

Medicare Part C (Medicare Advantage)

There are thousands of Medicare Advantage plans across the country. Each plan must abide by certain Medicare rules, but can be customized by the carriers. When you choose to enroll in a Medicare Advantage plan, you’re choosing to receive your health insurance through a private insurance carrier instead of the Medicare program.

Medicare pays Medicare Advantage carriers an allowance for each person enrolled in their Medicare Advantage plans. The carriers use this money to help cover your medical needs. Because the carriers receive a hefty allowance each year from Medicare, they can afford to offer low premiums. However, you pay this premium on top of your Part A and Part B premium.

These plans can offer additional benefits that Original Medicare doesn’t cover, such as dental, vision, hearing, and prescription coverage. They also provide beneficiaries with an out-of-pocket maximum that protects them from spending over a certain amount each year. This limit can be up to $6,700 in 2019.

However, there are a few details about Medicare Advantage plans that some people may look at as negative. For example, Medicare Advantage plans have networks in which you must stay within to receive coverage at reasonable costs. If you stray outside of this network, you could end up owing considerably more.

Medicare Part D

Medicare Part D provides Medicare beneficiaries with their outpatient prescription drug coverage. Like Medicare Advantage plans, Part D plans are sold by private insurance carriers. Each plan, although structured the same, has different costs and covers different drugs. The national average monthly premium for Part D is $35. However, premiums can be higher and lower.

Medicare Supplement plans (Medigap)

Medicare Supplement plans, also called Medigap plans, are another optional plan beneficiaries can enroll in to cut costs. You can choose from a Medicare Advantage plan that includes a Part D plan or a Medigap plan plus a Part D plan.

Medigap plans cut medical bills by covering the cost-sharing expenses of Part A and Part B. With a comprehensive Medigap plan, you could owe nothing other than the Part B deductible for Medicare-covered services.

Medigap plans, however, generally have higher premiums than Medicare Advantage plans. This is because they don’t get an allowance from Medicare, but still cover your back end costs.

Changes to expect with Medicare

Medicare changes from year to year to accommodate for the changes in healthcare. Changes can occur in costs, coverage, plan options, and more. The most talked-about change happening as of January 1, 2020, is the discontinuation of Medigap Plan F and Plan C.

At the beginning of the year 2020, Plan F and Plan C will only be Medigap options for people who turned 65 before 2020. Therefore, if you turn 65 in 2020 or later, you won’t have these plans to choose from. Fortunately, there are plenty of other fine Medigap plans to choose from.

Another change to look out for is Medicare Advantage plans being able to offer more home health services such as meal delivery, home modifications, custodial care, etc. More Medicare Advantage plans will be adopting this new coverage in 2020.

With all the moving parts of Medicare and the constant changes, you should always try to stay up to date on the latest Medicare news. Doing so will allow you to make sure you always have the most cost-effective coverage available to you.