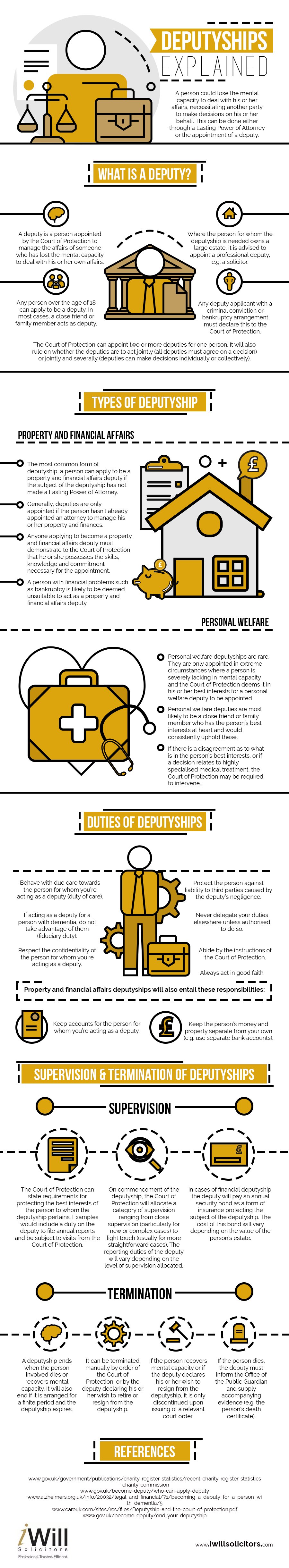

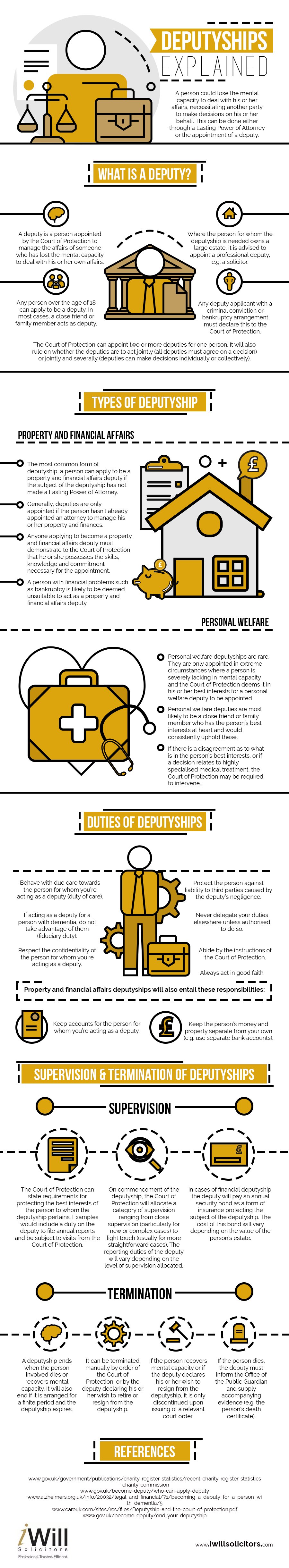

It can be frightening for a person to lose his or her mental capacity to such an extent that they can no longer make their own decisions, but where this occurs, a trusted family member or friend can be formally appointed as a deputy for them by the Court of Protection. This deputy will overtake responsibility for the person’s welfare and financial affairs and will usually be someone the person knows well. Where a large estate is involved, though, it is recommended to appoint a highly qualified professional such as a lawyer to act as deputy.

Most deputyships will concern the property and financial affairs of the person who has lost mental capacity. This gives the deputy the authority to make decisions regarding the person’s home and expenses, provided that any decision taken is in the best interests of the subject of the deputyship. Anyone with a questionable financial history (e.g. bankruptcy, fraud) is most unlikely to be approved as a property and financial affairs deputy. Where a person suffers a severe diminishing of mental capacity, a personal welfare deputyship could be arranged. This type of deputyship is rare and, in such cases, the deputy will almost always be a friend or family member.

Anyone chosen to act as a deputy should be a trustworthy individual who will consistently act for the good of the person involved in the deputyship; they will never abuse their position to exploit the person lacking mental capacity. Deputies are required to withhold the confidentiality and privacy of the person and cannot delegate their duties to others unless instructed to do so by the Court of Protection in extreme cases.

The experts at I Will Solicitors (http://www.iwillsolicitors.com/) produced this infographic which picks out the most important points to know about deputyships and explains the topic in a user-friendly fashion. Find out more about deputyships below.

Deputyships Explained infographic